Market Dominance

The next question is ok, well, what does that number mean. The best way to get an idea of what is going on here would be to establish a common denominator above which we could weigh the significance of the figure in question. We would do this simply by ascertaining the population. The 2015 census data collected by the Athens-Clarke County Unified Government indicates the total population living in the downtown Athens census tract 1 at a figure of 1,796, with 90% in group quarters (social explorer). Well, wait just one minute, how can the population be lower than the number of beds provided by one firm? We must assume the census data doesn’t include students, and this doesn’t help us, but it gives us an idea of the sheer magnitude of market power enjoyed by this one firm.

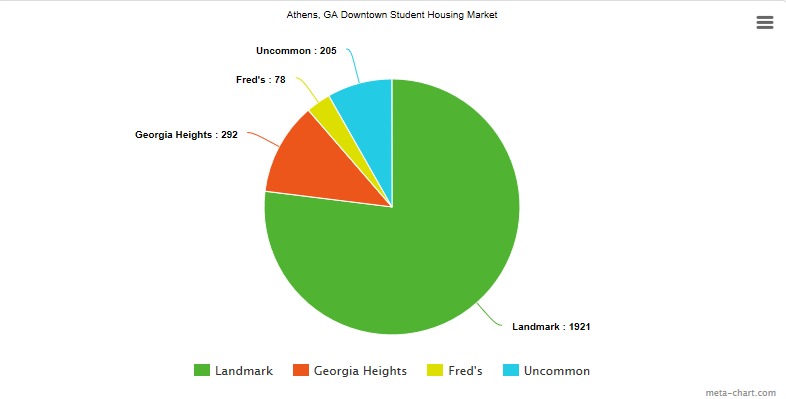

Without recourse to an accurate population number, which would allow us to analyze the situation with an objective metric, we will have to look at what it means for Landmark to have 1921 beds - relative to its competitors. If we take the arguably next top three suppliers of housing in the downtown Athens market, we can surely expect to find some noteworthy competition. Right? Let’s see.

Georgia Heights supplies the most handsome figure, at 292 beds; Uncommon was thrown into the mix this year, and furnished the market with an additional 202 beds. Fred’s historic downtown properties seems different, but its not. With 78 spread out beds—above Five Guys/Gyro Wrap/Ben & Jerry's/Wells Fargo/City Bar/Sand Bar/Centro/L-Z-Shopper/Flanagan’s/The Bury/ Whiskey Bent/Fred Building—Fred’s musters a significant concentration of market power in the Athens student real estate market. Even for all of that, we are nowhere close to presenting ourselves as formidable to the three titans along the north Oconee river. Between Georgia Heights, Uncommon, and Fred’s, we only muster a measly 575 beds to Landmark’s 1921.